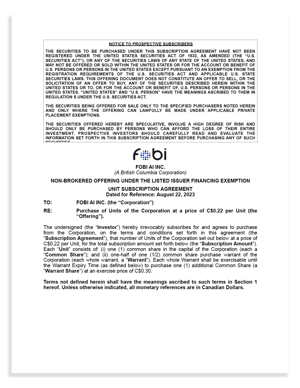

Fobi LIFE Offering Subscription Agreement

This non-brokered offering under the Listed Issuer Financing Exemption (LIFE) enables all investors, including those non-accredited, to participate in Fobi's current private placement, where securities purchased will NOT have a four-month hold and will be freely tradable upon settlement of financing.

*Details below*

Benefits of a Listed Issuer Financing Exemption (LIFE) Offering

Raising funds from the public by reporting issuers listed on a Canadian stock exchange just got much easier. On November 21, 2022, an amendment to National Instrument 45-106 Prospectus Exemptions (“NI 45-106”) went into effect to create a new exemption from prospectus requirements, known as the Listed Issuer Financing Exemption (LIFE). This exemption is a more efficient method for a listed reporting issuer to raise capital from the public through the issuance of freely tradeable listed securities. The exemption relies on the issuer’s timely and periodic disclosure documents available to the public on SEDAR (www.sedar.com), as supplemented by a short offering document. Listed issuers will be able to conduct small offerings and avoid the high cost and length of time required to prepare, file, and deliver a prospectus to potential investors.

The Listed Issuer Financing Exemption (LIFE) forms part of the ongoing efforts of the Canadian Securities Administrators to reduce the regulatory burden for reporting issuers, including providing efficient and cost-effective means for issuers to raise capital while maintaining investor protection.

The LIFE Offering is an exciting opportunity for both public companies and exempt market dealers, enabling them to expand their services into the public markets and giving public companies more choices in selecting partners to help them raise capital.

Another benefit to investors is that the securities purchased under the Financing Document will not have a four-month hold and will be freely tradeable. Compared to a private placement, the Subscription Agreement can be simplified, as companies will not have to confirm that the investor is eligible for other exemptions, such as being an accredited investor. Investors may value the increased flexibility compared to a private placement, allowing public companies to attract a wider pool of investors to the primary market.

In summary:

- Investors get all the benefits of a regular private placement

- Shares are immediately free trading on settlement (no four months and a day)

- Non-accredited investors are eligible to participate